Emerging Markets Volatility Augments DGCX FX Volumes

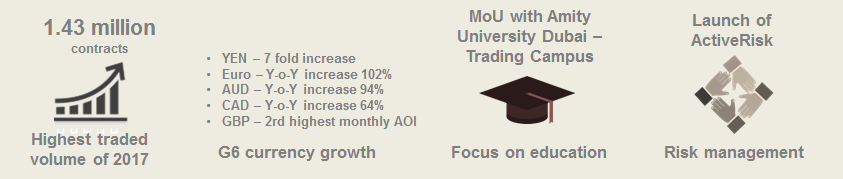

Dubai, 01 June 2017: As volatility slowly crept back into Emerging Markets, the Dubai Gold & Commodities Exchange (DGCX) witnessed a spike in FX products’ trading during the month of May. DGCX, which is the region’s largest and most diversified exchange currently lists thirteen currency pairs. The increase in volatility helped the Exchange record its highest traded volume of the year with over 1.43 million lots traded in May.

Trading volumes in DGCX’s Non-INRUSD FX segment grew 53% from the same period last year. Amongst the G6 currency pairs, Japanese Yen saw a seven-fold increase in volume. While the Euro, Canadian Dollar and Australian Dollar futures saw significant year-on-year increases of 102%, 94%, and 64% respectively which marked the latter two pairs best performance to-date.

Among the precious metals products, the recently listed Shanghai Gold futures traded an impressive volume of 2,889 contracts valued at CNH 805 million. The Yuan (CNH) denominated gold product has had a positive knock-on effect on DGCX’s other gold products including the Loco Dubai Spot Gold which continued to shine recording strong growth of 1131% from last year. Trading in Silver futures also saw volume growth of 101% from April 2017.

DGCX has also increased its focus on expanding its educational initiatives and enhancing its risk management systems.

The Exchange has been actively involved in educating the trading community, ranging from avid traders to students, through its Trading Campus – launched in collaboration with the Envision Trading Centre. Trading Campus and the DGCX signed a MoU with Amity University Dubai to deliver a specialized course on financial markets with exposure to real-time markets by using live trading simulators during the month of May.

Gaurang Desai, CEO of the DGCX, commented: “We are focused on creating long-term value for our stakeholders and market participants. Whether it is building liquidity in products, raising awareness or imparting the right knowledge; we want to make sure traders and investors are prepared for the challenges of fast moving markets. The economically turbulent landscape of 2017 has highlighted the need to make ‘informed choices’ in order to protect oneself from market adversities. ‘Informed choices’ can only be made by possessing the appropriate knowledge and skills with regard to investing and trading whilst trying to achieving the balance between risk and reward. This is why we are adding increased emphasis on our educational agenda, and hope to educate as many traders and investors in the UAE and the wider region to benefit from ‘informed choices’.”

The Exchange also recently launched a highly efficient and improved Risk Management System called ActiveRisk. The state-of-the-art risk management system will identify the aggregate counterparty credit risk during default scenarios. It has been implemented by the Dubai Commodities Clearing Corporation (DCCC), DGCX’s Central Counter Party (CCP), to enhance regulatory compliance with the IOSCO-PFMI and ESMA standards.

“We are constantly improving our processes, systems and compliance standards to match them with international benchmarks. As the leading exchange in the region, we are committed to provide our community with robust risk management tools and cutting-edge knowledge to trade and transact with confidence,” concluded Gaurang.

ENDS

About DGCX: Established in 2005, DGCX is the region’s leading derivatives exchange and the only one allowing global participants to trade, clear and settle transactions within the Gulf region. The Exchange has played a pioneering role in developing the regional market for derivatives and financial infrastructure. DGCX is an electronic commodity and currency derivatives exchange with over 200 members from across the globe, offering futures and options contracts covering the precious metals, energy and currency sectors. DGCX is a subsidiary of DMCC (Dubai Multi Commodities Centre), a Dubai Government Authority for trade, enterprise and commodities. For more information: www.dgcx.ae

DGCX also owns and operates the region’s largest and only multi-asset Clearing House – Dubai Commodities Clearing Corporation (DCCC). DCCC is federally regulated by the Securities & Commodities Authority (SCA) and is recognized as a Third-Country CCP by European Securities Markets Authority (ESMA) with over 80 clearers from across the globe. For more information: www.dccc.co.ae

Further Information:

Meng Chan Shu

Director of Business Development and Sales

Dubai Gold and Commodities Exchange

Tel: +9714 361 1660 Email: meng.shu@dgcx.ae

OR

Dhanya Issac/Lara Batato

Weber Shandwick PR

Tel: +971 (0) 4 445 4222

Email: dissac@webershandwick.com / lbatato@webershandwick.com

RISK DISCLAIMER: Trading in futures products entails significant risks of loss which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies cited herein is not necessarily indicative of future performance. The information contained herein is provided to you for information only and believed to be drawn from reliable sources but cannot be guaranteed; Phillip Capital Inc. assumes no responsibility for errors or omissions. The views and opinions expressed in this letter are those of the author and do not reflect the views of Phillip Capital Inc. or its staff.